ISLAMABAD:

According to a recent study, Pakistan’s economy stands out as an outlier in Asia and would have the highest inflation rate but the fourth-lowest rate of economic growth among the region’s 46 economies.

The economic growth prognosis for the current fiscal year has been marginally cut down to 1.9% in The Asia Development Outlook, the ADB’s flagship publication, but the inflation forecast has been dramatically increased to 25%.

Inflation will be highest in Pakistan

The report recommends for a fiscal consolidation plan that limits expenditure on defense and energy subsidies and expects interest rates to rise further.

The research also notes that Pakistan’s currency has experienced a sharp devaluation of 30%, while the currencies of rising economies in Asia have just slightly declined. Pakistan experienced a drop in international remittances, in contrast to other regional economies.

- Advertisement -

The ADB observes that Pakistan’s economic outlook carries very substantial downside risks.

Before, Pakistan’s economic prospects were just considered to be dismal within South Asia, but as things have continued to become worse, the nation has fallen to near the bottom of Asia.

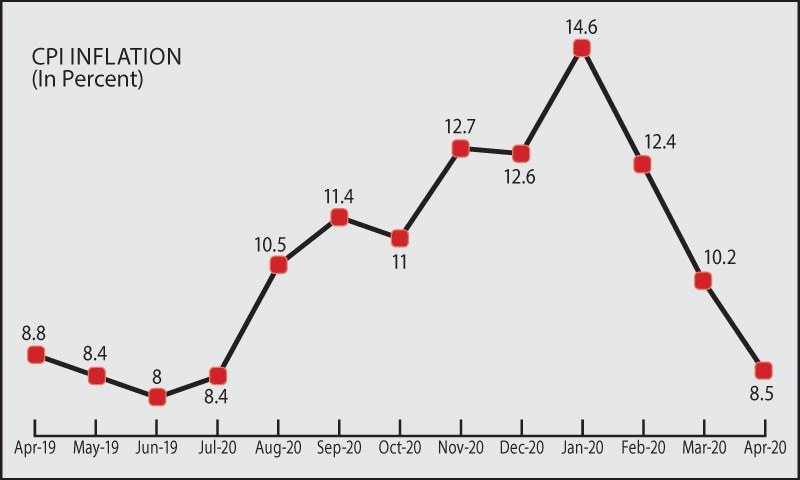

According to the paper, “inflation is forecast at 25%, sharply higher than the earlier projection of 15%” for FY2024. This inflation rate is significantly greater than the central bank’s target range and target. It is the year’s highest inflation rate.

According to the paper, “inflation is forecast at 25%, sharply higher than the earlier projection of 15%” for FY2024. This inflation rate is significantly greater than the central bank’s target range and target. It reflects the highest rate of inflation in Asia and is much higher than the predicted 10% inflation rate for all other economies.

The ADB predicts that inflation will have increased from the previously predicted 27.5% in April to 29.2% in the most recent fiscal year.

The analysis emphasizes that regional currencies have only slightly appreciated versus the US dollar so far this year, or 3.7% on a GDP-weighted average basis. However, since January, Pakistan’s currency has devalued significantly by 30%.

The ADB contends that attempts by the government to regulate the exchange rate resulted in the formation of a secondary foreign exchange market with a significant premium over the primary market rate. This in turn promoted the use of the parallel market for inbound remittances and proceeds from service exports, which in turn led to a further tightening of foreign currency liquidity in the interbank market. Consequently, in FY2023, recorded worker remittances decreased by $4.3 billion, reaching $27 billion.

In comparison to the same period in 2022, net personal transfers rose by 13% in Nepal and 9% in Bangladesh, but fell by 17% in Pakistan.

According to the research, stabilized food supplies and decreased inflation expectations, offset by increasing gas and electricity prices and a predicted currency depreciation, could moderate inflation in FY2024. However, the inflation rate in Pakistan is still anticipated to stay at 25% in FY2024, which is significantly higher than anticipated in April.

Economic Growth Rate

Pakistan’s growth forecast for this fiscal year has been marginally lowered by the ADB from the initial projection of 2% to 1.9%. The official 3.5% target for this fiscal year is less than this range.

The 1.9% growth target is contingent on reform execution, benevolent macroeconomic policies, supply shock recovery from floods, and better external conditions. If achieved, political stability after the general elections later this year is anticipated to increase corporate confidence. This confidence will also be boosted by the new standby agreement reached with the International Monetary Fund (IMF) to promote economic stabilization and strengthen fiscal buffers.

According to the ADB, the IMF’s economic adjustment program’s success will be crucial to the economy’s near-term prospects. While uncertainty will continue, stabilization efforts will stop the demand from rising. Demand will be hampered by tighter fiscal and monetary policies as well as by double-digit inflation.

Fiscal Actions

The report also mentions containing spending and increasing revenues to tighten the budget. The FY2024 budget aims for an overall deficit of 7.5% of GDP and a primary surplus of 0.4% of GDP, both of which will steadily decrease over the next two years. Provincial spending will be reduced by 0.4% of GDP, and spending on energy and defense subsidies will be restrained while priority social and development expenditures are preserved.

Rates of Interest

The ADB predicts that in order to progressively bring inflation down to its medium-term target of 5% to 7%, the central bank will probably increase the policy rate from the 22% set in July 2023. The central bank has committed to achieving real interest rates that are positive, forgoing the implementation of new refinancing plans, and limiting refinancing credits.

Significant inflationary pressures do, however, still exist. The scheme is anticipated to result in sharp rises in gas, electricity, and petroleum tariffs. The rupee could weaken more when import and currency rate curbs are loosened, increasing the cost of imported items. In FY2024, it is anticipated that the current account deficit will rise to around 1.5% of GDP. Despite the bigger deficit, global reserves ought to increase.

The ADB issues a warning that the outlook still carries extremely significant downside risks. The economy will be affected by tighter global financial conditions and probable supply chain disruptions from any escalation of the Russia-Ukraine conflict. Implementing change to stabilize development, rebuild confidence, and achieve sustainable debt will continue to be significantly risked by ongoing political unrest during the forthcoming election season. Payments from bilateral and multilateral partners will continue to be essential for reserve building, stable currency rates, and boosted market sentiment.